MARKET RESEARCH

_______________

We create first-hand retail and real estate market reports with intelligence drawn from our strong network and our nuanced understanding of brands and their core clientele.

CO-TENANCY AND

COMPETITION ANALYSIS

NEIGHBORHOOD ANALYSIS

CONSUMER DEMOGRAPHIC

RESEARCH SITE

COMPARISONS

CORE CUSTOMER ANALYSIS

We assisted a contemporary women’s retailer in analyzing and interpreting their sales data, which allowed them to identify their true customer and propelled the restructuring of their store fleet. By identifying malls as a key sales driver and accessories as a cornerstone of their business, we worked on a potential mall pop-up strategy and are actively repositioning their street locations.

MARKET COMPARISONS

We performed first-hand quantitative & qualitative consumer research in Chicago & New York for an online retailer, comparing multiple markets and sites to identify which would allow for the greatest market penetration and performing an analysis of foot traffic, key demographics, & consumption patterns.

trusted networks

_______________

We bring together top-tier visionaries, across industries and sectors. Our trusted network of investors, architects, engineers and experts allow us to maximize value through collaboration.

WE WORK WITH

Architects, interior designers, private investors, institutional investors, REITs, engineers, surveyors, construction specialists, photographers, editors, stylists.

Strategic planning

_______________

Our unparalleled knowledge of retail & real estate markets allows us to craft impactful & effective strategic decisions.

MARKET ENTRANCE AND BRICK & MORTAR PLANNING

RENT AND COST ANALYSIS

POPUPS AND ACTIVATIONS

CASE STUDY

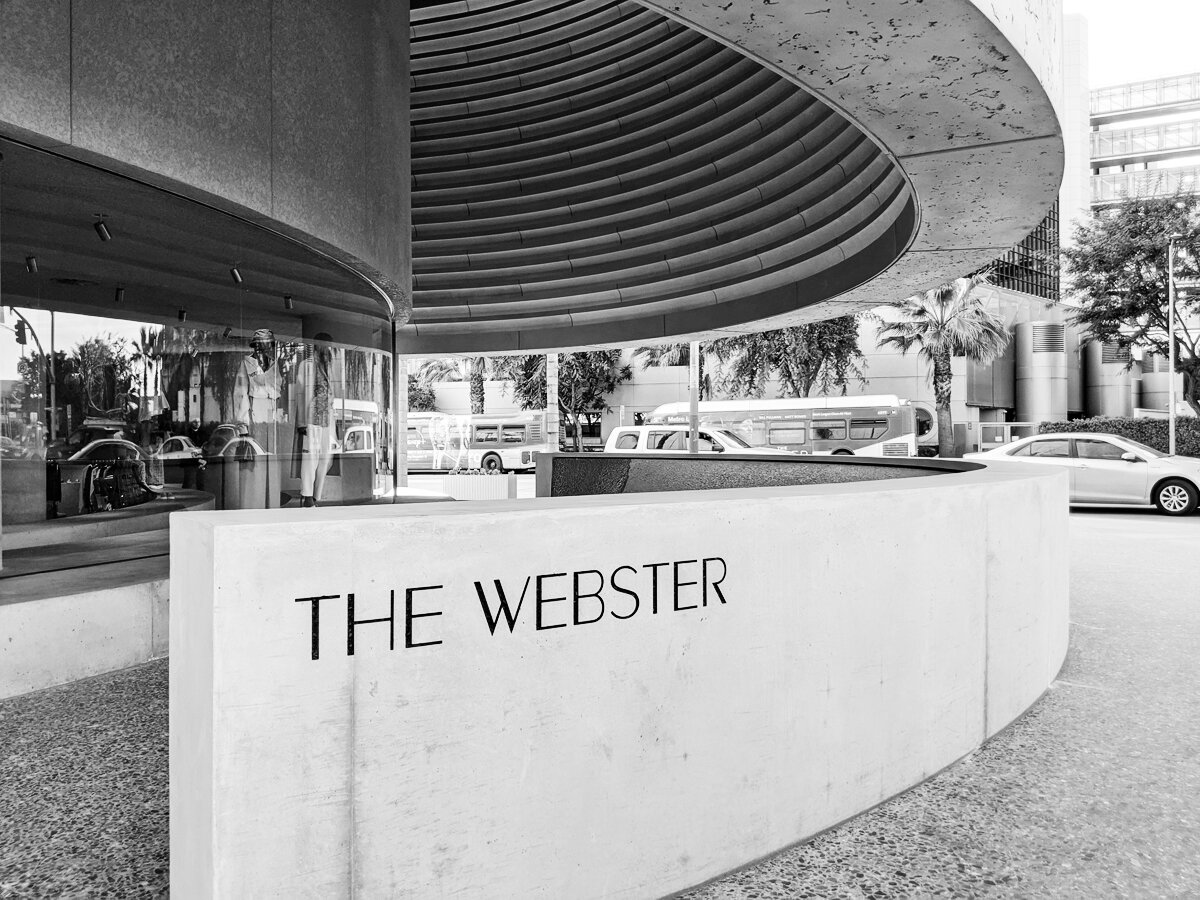

THE WEBSTER / BEVERLY HILLS

In 2018, Robin Zendell & Associates represented the Webster, a luxury fashion retailer, in leasing its Los Angeles flagship location at the Beverly Center for a 10 year term. The 11,000 square foot store, which opened in February 2020, is its first Los Angeles location. The pink concept store was designed by legendary British architect Sir David Adjaye. The store is considered the “centerpiece” of the intersection of the highly trafficked Beverly and San Vicente Boulevards. The Beverly Center project has recently undergone a $500 million “reimagination” to allow for a more contemporary aesthetic, which lured The Webster.

STORE VS. SHOWROOM

We explored the NYC retail market for beauty retailer Bastide, and concluded that, prior to opening a standalone retail location, the best strategy for their initial entry into physical space was a combined office/showroom

FROM DIGITAL TO BRICK & MORTAR

We worked with digitally-born Everlane to test the retail market and execute proof of concept with a series of pop-up stores in key markets prior to the opening of their first permanent location. Select activations continue to work hand-in-hand with their brick and mortar expansion strategy.

USA EXPANSION

We analyzed key markets in the United States for the London based fashion brand, Margaret Howell. Through a series of case studies, we understood key retail markets on a macro and micro level, as well as a projection on retail sales by door to create example P&L scenarios.

SITE SELECTION

_______________

We secure on & off-market retail, office and showroom sites across key markets both in street locations and within malls & shopping centers, negotiating rents & deal structures that reflect our clients’ goals & best interests setting them up for both longevity and success

CASE STUDY

DIOR / 767 FIFTH AVENUE

Robin Zendell & Associates represented Christian Dior in leasing over 11,000 SF of retail at 767 Fifth Avenue, on the corner of 59th street and Fifth Avenue, adjacent to Apple’s new flagship location. This transaction, cemented the the 59th Street block between Madison and Fifth Avenues as the leading luxury corridor in New York City. This new space will serve as Dior’s temporary location for the next three years while the brand remodels and expands its current flagship on 57th Street and Madison Avenue.

RETAIL FLAGSHIP

We secured a new flagship on Fifth Avenue in New York City for a luxury watchmaker, negotiating an aggressive deal at nearly half the original asking rent with a flexible lease term. This deal will allow the brand to ride out the shifting retail market and adapt to the evolving face of Fifth Avenue in the coming years

OFF MARKET TRANSACTION

Foregoing traditional leasing strategy, we assisted a luxury client in the purchase and conversion of an artists’ live-work building in NYC’s Soho neighborhood, securing their first city location & achieving the retailer’s targeted ROI. Drawing on our extensive network, we worked quickly and over the holidays to secure this off-market transaction.

NETWORK BASED SOLUTIONS

We leveraged our network to connect two clients looking for space - an art PR firm and a European gallery. Together they leased one large office/showroom at a below-market rent, dramatically offsetting their costs.

Lead advisory & management

_______________

We carefully track our clients’ lease portfolio to ensure they’re optimally positioned, re-negotiating & restructuring as necessary.

IN-DEPTH LEASE PORTFOLIO ANALYSIS

LEASE RENEGOTIATION

SUBLEASE AND ASSIGNMENT

EXIT & REPOSITIONING STRATEGIES

CASE STUDY

RIMOWA / 99 PRINCE STREET

Robin Zendell & Associates was brought on in 2015 to represent the landlord in leasing the retail space at 99 Prince Street, a retail space at the base of the Mercer Hotel. The existing tenant, Aquazurra, wanted out of their lease, meanwhile Rimowa, a company owned by LVMH, was interested in seeing the space, knowing they wanted to expand their New York presence into the Soho market. They were immediately impressed by highly trafficked location and character of the jewelbox space. In the winter of 2019, Robin successfully closed this deal, leasing the 900 SF space for 5 years and acting as both the landlord and tenant rep. The store is set to open in the Spring of 2020.

EXPANSION PLANNING

We’re working side-by-side with one of Europe’s foremost lingerie brands to analyze East and West Coast markets and specific retail locations, in order to assure the longevity and success of new stores as they roll out across the US.

MARKET REPOSITIONING

We’re spearheading the US exit of a European menswear brand from multiple mall locations along the East Coast, leveraging landlord relationships to negotiate the greatest capital savings while analyzing key performance indicators to strategize a successful re-entry into the U.S. market.

acquisitions & dispositions

_______________

We assist clients with-off-market transactions and investment purchases as well as strategic dispositions of commercial real estate assets.

CASE STUDY

THE WEBSTER / 29 GREENE STREET

In 2013, Robin Zendell & Associates represented The Webster, a luxury multi-brand retailer, in purchasing the 2-story cast iron building at 29 Greene Street in Soho. Around this time period, retail tenants were beginning to look to the southern stretch of Soho for more affordable deals and a more authentic neighborhood experience, Robin took note. By purchasing 29 Greene, between Canal and Grand Streets, The Webster was at the forefront of this shift south and was a major catalyst in further increasing its appeal. The Webster renovated and reconstructed the two-story building, adding on four stories and putting in over $20M of capital. The renovation helped restore the building closer to its original appearance from the 1800s, which was destroyed by a fire in the 1970s. The Webster’s fifth boutique, The Webster SoHo New York, is a 12,000 square foot store that opened in November 2017. It is home to over 200 luxury brands and boasts a highly curated collection of fashion, art and homewares.

retail consulting

_______________

We create first-hand retail and real estate market reports with data and intel drawn from our strong network and our nuanced understanding of brands and their core clientele.

IN-DEPTH LEASE PORTFOLIO ANALYSIS

LEASE RENEGOTIATION

SUBLEASE AND ASSIGNMENt

exit & REPOSITIONING STRATEGIES

CASE STUDY

MARGARET HOWELL /

USA EXPANSION REPORT

We analyzed key markets in the United States for the London based fashion brand, Margaret Howell. Through a series of case studies, we understood key retail markets on a macro and micro level, as well as a projection on retail sales by door to create example P&L scenarios.

USA EXPANSION

We worked with The Fold, a Direct-to-Consumer fashion brand based in Europe, on various expansion scenarios into the US Retail market. We focused on New York, illustrating and mapping out which neighborhoods would most effectively align with that of the brand’s customers. Through a series of qualitative and quantitative exercises, we identified the most effective points of entry for the brand as they expand into the market.